Urban Growth Centres will be difficult to create

Section 2.2.4 of the Plan identifies 25 "Urban Growth Centres" that are intended to be a focus of population and employment growth and investment in transit and other infrastructure. This policy is the most recent version of a series of nodal concepts for the region that have appeared in plans by various levels of government since the 1950s. The Growth Plan is more ambitious than previous policies in terms of both the number of centres it designates and its expectations of each centre.

History shows that creating fully developed centres or nodes is difficult. Thirty years of policy promotion have led to the creation of only four major nodes: Yonge and Eglinton, North York Centre, Scarborough Town Centre and Mississauga City Centre. While denser than their surroundings, each has significant shortcomings with respect to residential-employment balance and transportation behaviour. In a study of three established suburban nodes, University of Waterloo Professor Pierre Filion found that due to problems in their internal design and lack of connections to their surroundings, the nodes failed to exhibit what he calls "inner synergies" -- for example, high levels of patronage by office workers of retail and food establishments within the centre. In fact, a significant proportion of people who work in nodes were shown to use automobiles to travel within the node and a large majority used automobiles to travel to the node.3 Overcoming these tendencies will require tight integration with and investment in local and regional transit systems and urban design guidelines that promote a fine-grained mix of uses.

Different types of Urban Growth Centres will require different policies and incentives

The Growth Plan differentiates Urban Growth Centres by the density they are to achieve by 2031 -- 400 people plus jobs per hectare for those in the City of Toronto, 200 for those in the rest of the Inner Ring and Waterloo Region, and 150 for those in remainder of the Outer Ring. To bring about these densities, the policy might recognize the differing histories and characteristics of the centres. [See Fig. 7.] Examination of the centres' characteristics seems to indicate that the purpose of the policy differs from one type of centre to another. For some, the expected outcome seems to be the revitalization and economic development of depressed areas such as satellite city downtowns; for others, it is to encourage growth in not yet fully developed areas. To achieve these differing outcomes the Plan should contain specific policies and incentives for different types of centres.

Fig. 7: four types of urban growth centres

Instead of categorizing Urban Growth Centres by target density, the Growth Plan policies could distinguish them by their differing histories and characteristics.

1. Centres developed within, or surrounded by, a fully built-up urban environment that are reasonably well served by local transit, such as Yonge-Eglinton, North York Centre, downtown Oakville, and downtown Burlington. Further intensification of these areas may encounter citizen opposition.

2. Existing centres with space for future expansion, including Scarborough Town Centre, Mississauga City Centre, Pickering Centre, and Brampton Centre. These car-oriented areas are largely disconnected from surrounding low-density neighbourhoods. Intensification will require substantial investment in high-quality transit and the redevelopment of surface parking.

3. Centres in outer suburbs that are to be developed on greenfield sites, including Vaughan Corporate Centre and Markham Centre. Their success will depend on the appeal of high-density, transit- and possibly pedestrian-oriented design within outer suburbs whose development has until now been mostly focused on the car.

4. The downtowns of satellite cities that have experienced decades of declining population and employment, such as Brantford and Peterborough. Although these areas have excellent redevelopment potential, substantial investment will be required to break the cycle of decline.

Concentrating employment will be a monumental task

Residential concentration into centres will be hard enough. Employment concentration is likely to be even more difficult. Section 2.2.6.3 of the Growth Plan calls for major office development -- defined as 10,000m2 of floor space or more -- to be located in "urban growth centres, major transit station areas, or other areas with existing frequent transit service, or existing or planned higher-order transit service."4 While in theory office and retail jobs are compatible with and could be moved to nodes, it is far from certain that private enterprise will be attracted to these areas. Research shows that policies promoting the creation of employment concentrations in mixed-use centres have met with limited success in Greater Toronto and elsewhere.5 In fact, over the past 15 years, the vast majority of office floor space has been constructed in low-cost, highway-oriented, non-transit serviced locations. [See Fig. 8.]

It is easier to concentrate residential and retail land uses than it is to attract other forms of employment to urban centres, because they cannot compete with business parks on cost. Footloose firms will choose the least expensive location that suits their needs, especially with respect to low-cost parking. A 2003 study commissioned by the Greater Vancouver Regional District found that the cost of parking construction and lack of automobile access was a major deterrent to businesses locating in designated Regional Town Centres.6 Dr. Pamela Blais has also found that the current parking standards were a major impediment to achieving denser development in nodes, along with property tax and development charge structures that discourage denser, nodal development. This is affirmed by economist Dr. Peter Tomlinson, who has shown that variation in property tax rates plays a significant role in determining where businesses choose to locate or expand in the GTA and other metropolitan regions.7

Urban Growth Centres as transit nodes

The Growth Plan concept map displays many future higher-order and inter-regional transit lines connecting Urban Growth Centres to one another. Extraordinary investment would be required to make many of these centres function as nodes of local and regional higher-order transit systems, which the Plan defines as heavy and light rail or buses in their own rights-of-way. Of the 25 centres, four are not currently served by higher-order transit at all. Five are served solely by VIA Rail and eight solely by GO Rail. Only the five centres in the City of Toronto are served by all-day, frequent-service, higher-order transit, and another five are served by more than one mode of higher-order transit.10

Furthermore, it is unclear why some of the proposed links are necessary. The potential number of journeys between centres may in some cases be too small to justify the enormous expense necessary to build high-capacity connections between them. A balance is needed. While there is a demonstrable need for higher-order transit connections between some centres -- a need not met by the current radial structure of the GO and subway systems -- focusing land use policies and transportation investment within the catchment areas of nodes may pay larger dividends in terms of reduced automobile travel. Strong local transit services are the necessary foundation of long-haul transit lines that connect centres. The addition of a policy promoting development at "major transit station areas" in the latest iteration of the Plan could increase transit ridership and permit higher-frequency service as well as revitalizing the areas around underdeveloped TTC subway and GO station areas.

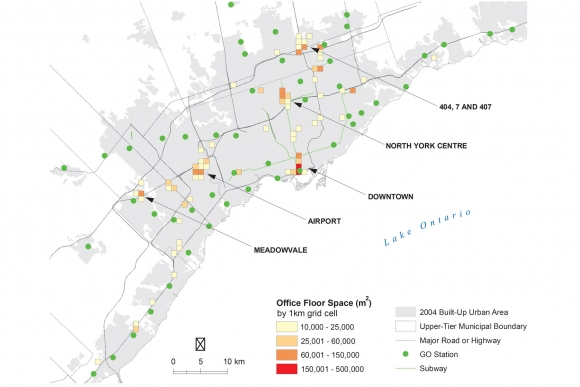

Fig. 8: Few offices locating in existing centres, 1990-2004

The Greater Toronto market area contains over 14.8 million square metres of commercial office space, of which 3.8 million square metres has been constructed since 1990. Buildings of over 10,000m2 of floor space account for half of all office buildings and 80% of all floor space constructed since 1990.8 A 2005 Canadian Urban Institute study for the Toronto Office Coalition indicates that between 1993 and 2005, 62% of new office floor space was constructed in non-transit-supportive office parks. Less than 6% was constructed in commercial subcentres, including North York Centre, Scarborough Town Centre, and Mississauga City Centre.9

The Growth Plan seeks to attract office buildings of larger than 10,000m2 to areas served by existing or planned higher-order transit, which the Plan defines as heavy and light rail or buses in their own rights-of-way. The two maps show the location of office floor space built after 1990 in buildings larger and smaller than 10,000m2. In each map, floor space has been aggregated up to a 1-km grid. Each coloured square on the map indicates the presence of at least one building; the darker the colour, the more floor space within the square.

The maps indicate that, with the exception of downtown Toronto and North York Centre, office space has located in areas that are not served by higher-order transit. Highway access has been the basic determinant of office location. The two major concentrations of office floor space that have emerged since 1990 are at Pearson Airport and the nexus of Highways 404, 7, and 407 -- both off the major transit grid. Meadowvale and, to some extent, the QEW corridor in Oakville illustrate the potential for linking office development to the GO rail system.

Note: Office floor space data was generously provided to the Neptis Foundation by InSite Real Estate Information Systems, http://www.realinsite.com/about/default.asp.

Major office space more than 10,000 sq.m built

Major office space less than 10,000 sq.m built

The absence of a transport plan

Creating a system of mixed-use, transit-oriented centres will be difficult, but not impossible. Most of the weaknesses in the expected function of the growth centres would seem to be related to the absence of a phased transportation investment plan at the Greater Golden Horseshoe level. A transportation investment plan is an essential precursor to the revision of municipal official plans. In tandem with the transportation investment plan, there is a need to indicate more fully what is to be expected from different types of centres, major transit station areas, and associated corridors, including guidelines for their design and function.

Further analysis is needed to shape these expectations. Studies of current travel patterns within and between nodes could show where transit investments would achieve the best returns. By modelling different land use and transport scenarios, it will be possible to compare the potential impact on transit use under different configurations. At the same time, the degree to which intensification areas could draw employment away from business parks could also be assessed and incentives designed to achieve the Growth Plan's policy objectives.