The High Order Business Services (HOBS) Archetype consists of companies that serve other businesses. It includes accounting, law, business management, headquarters, and some scientific and technical consulting.[1] In 2016, it represented 123,000 jobs in the GGH, and has shown strong job growth - some 25,000 additional jobs, or an increase of 25 percent, between 2006 and 2016.

Table 9: High Order Business Services Archetype Employment, GGH, 2006 and 2016

| 2006 | 2016 | Change | % Change |

High Order Business Services | 98,215 | 123,345 | 25,130 | 25.6 |

Archetypes total | 1,481,595 | 1,459,825 | -21,770 | -1.5 |

Total GGH core employment | 2,300,015 | 2,375,465 | 75,450 | 3.3 |

Total GGH employment | 3,437,935 | 3,710,915 | 272,980 | 7.9 |

HOBS establishments provide advice, knowledge, information, and expertise to client firms. In this sector, "products" are often customized and co-produced with clients and are generally high-value-added or high-order services. HOBS play an important role as producers of knowledge and information, facilitators of information and knowledge exchange, and sources of specialized know-how, all of which support the potential for innovation, exports, and economic development.[2]

HOBS tend to concentrate in large urban centres and deliver services across large territories from their urban bases.[3] As these firms often collaborate with their clients, HOBS locations tend to reflect those of their clients. Access to a skilled talent pool is another locational factor.

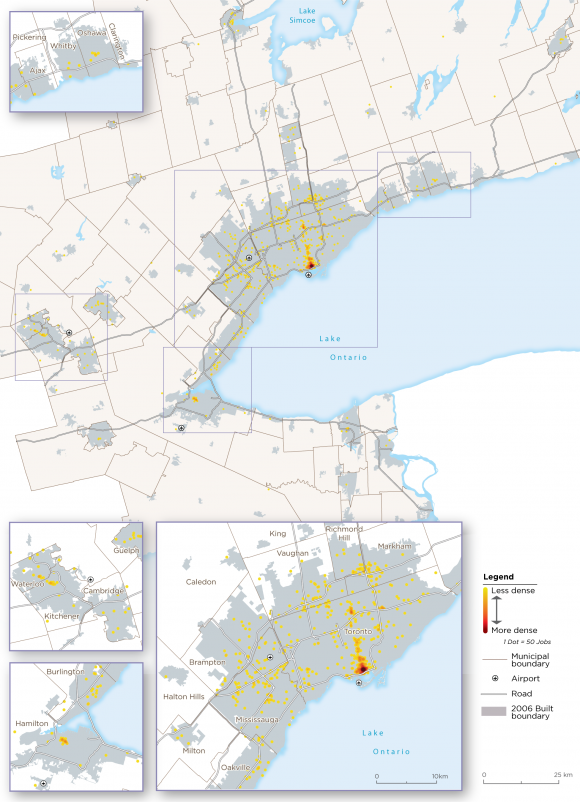

The geography of HOBS employment in the GGH shows a dominant concentration of jobs in Downtown Toronto, which extends along the Yonge Street corridor to the North York City Centre. Other concentrations are found in the Markham SKID, the Airport SKID, and in Hamilton centre. Additional employment is scattered in suburban locations, especially along the Highway 401 and 407 corridors.

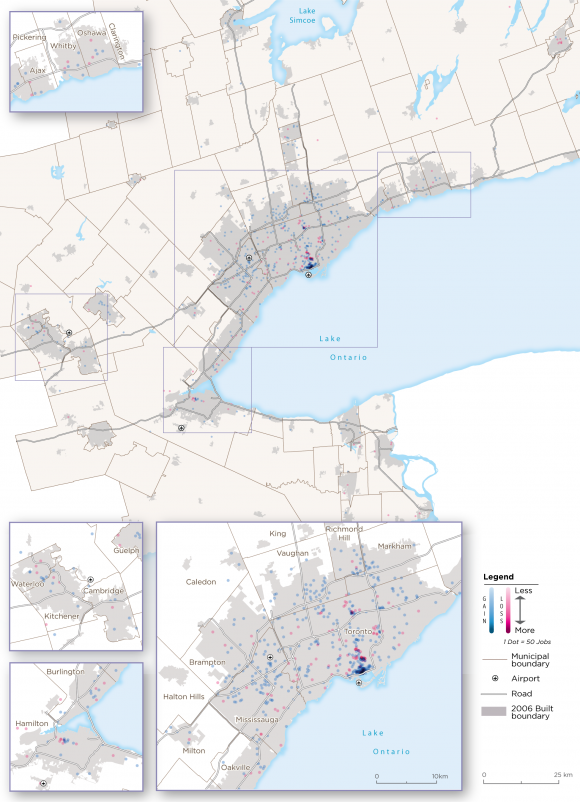

Employment change between 2006 and 2016 generally reflects this existing pattern. The dominant concentration of growth is in the downtown. Some areas experienced job loss; these tend to be scattered across the region. (See Maps 7 and 8.)

Like jobs in the Finance Archetype, HOBS employment is found in both urban and suburban locations. The urban environment characteristics of Downtown Toronto and the older planned node of North York City Centre, as well as the SKIDs have already been described.

HOBS are also found in older downtowns, where they likely serve other local businesses. Hamilton centre is an example of an older city centre, like the downtowns of Brampton, Kitchener, Oshawa, or Burlington. These areas are relatively dense, and contain a wide mix of uses, including office, residential, institutions, shopping, and services. As these city centres were laid out before the Second World War, their environments tend to be compact, walkable and cyclable, with low- to mid-rise buildings, parks, and a high-quality urban realm. Most have good transit service, often with connections to the region as a whole through the GO train network. Over time, they have been through various phases of development and redevelopment.

While the fortunes of HOBS businesses are closely linked to their client industries, some also export their services. In fact, management services was one of the fastest-growing export sectors in Canada (see Figure 4, above).[4]

Map 7: High Order Business Services Archetype Employment, GGH, 2016

Map 8: High Order Business Services Archetype Employment Change, GGH, 2006-2016

[1] The Archetype includes NAICS 5416, "Management, scientific and technical consulting services." That category is included in HOBS because the most significant occupational category in the industry is "professionals in business and financial consulting," that is, the industry is more financial and business management-oriented than scientific.

[2] Richard Shearmur and David Doloreux, "Conceptualising KIBS as both innovators and service providers to innovators: an exploration of firm-level and geographic factors," working paper, 2017.

[3] Shearmur and Doloreux, "Conceptualising KIBS," 2017.

[4] Palladini, Spotlight on Services, 2015.