The Other Manufacturing Archetype includes all manufacturing jobs that have not been included in other Archetypes (that is, excluding manufacturing in the Hard Tech, Science-Based, and Special - Aerospace and Pharma - Archetypes). This Archetype represents the largest number of jobs of all Archetypes - 386,000 in the GGH in 2016 - and is a backbone of the GGH economy. It also exhibited one of the highest rates of job loss - 130,000 jobs lost between 2006 and 2016, a 25 percent decline.

Table 19: Other Manufacturing Employment, GGH, 2006 and 2016

| 2006 | 2016 | Change | % Change |

Other Manufacturing | 516,255 | 386,480 | -129,775 | -25.1 |

Archetypes total | 1,481,595 | 1,459,825 | -21,770 | -1.5 |

Total GGH core employment | 2,300,015 | 2,375,465 | 75,450 | 3.3 |

Total GGH employment | 3,437,935 | 3,710,915 | 272,980 | 7.9 |

Job losses were not confined to a few industries, but were experienced across all the 4-digit industries that make up Other Manufacturing. Only a handful of industries experienced modest gains or remained stable. The most significant losses were sustained in motor vehicle parts manufacturing (down almost 18,000 jobs), plastic products (down 13,000 jobs), and printing (down more than 9,000 jobs).

Manufacturing employment is found across the GGH's employment lands, with some especially dense areas in the Vaughan and Airport megazones, Guelph, central Hamilton, and the City of Toronto's inner suburbs.

The geography of job loss is also widespread across the region. Areas of concentrated job loss include the older areas of Oshawa, central Hamilton, and Kitchener. Despite overall job losses in the region, a few areas show growth, including Meadowvale, north Guelph, and eastern Oakville. There is also scattered growth at or near the urban edge, in the newest employment areas. (See Maps 31 and 32.)

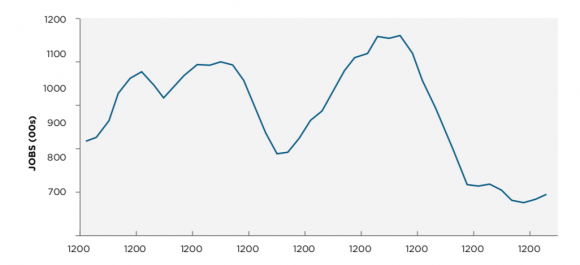

Manufacturing job loss is not a recent phenomenon (see Figure 6).[1] Rather it is a long-standing pattern associated with freer trade, fluctuations in exchange rates, and more recently, the adoption of automation technologies. In particular, the globalization of production and supply chains (enabled by information technology) and the automation of production with robots are key drivers of change. Figure 6 shows the trajectory of manufacturing employment in Ontario over the last 40 years, including a decline post the 1989 Canada-U.S. free trade agreement, and declines since 2000. However, it is worth noting that in Ontario as a whole, the precipitous decline seems to have let up, and manufacturing employment has been relatively stable in recent years.

Figure 6: Employment in manufacturing, Ontario, 1976-2017

Falling trade barriers and shipping costs, combined with a revolution in global communication and lower labour costs overseas have led to large-scale off-shoring of routine production. The resulting reconfiguration of production on a global scale led to a loss of Ontario-based branch plants to the U.S., Mexico, China, and other low-cost locations. The impacts were especially felt in Ontario and the GGH, given the concentration of manufacturing found in these jurisdictions.

As well, automation, including the use of industrial robots in manufacturing, has been growing and transforming production processes. The automotive sector is the most robot-intensive manufacturing industry,[2] a fact with particular implications for Ontario and the GGH.

As globalization proceeds with the further integration of markets, such as the Canada-European Union Comprehensive Economic and Trade Agreement (CETA) and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), its helpful to understand where the GGH is situated along the path of rationalizing production processes and restructuring. Is there potential for further restructuring and contraction or loss of manufacturing firms - or is most restructuring already complete as a result of previous trade liberalization?

Although we cannot provide a definitive answer, we can make a few observations. The impacts of freer trade as a result of recent agreements such as CETA and the CPTPP could be expected to have relatively modest impacts. Analysis of the potential impacts of CETA, for example, suggests an overall increase of 9 percent in exports of Canadian goods.[3] However, there is considerable variability in the impacts between industries. While some manufactured products, such as apparel and motor vehicles, are expected to see a bump in exports, others, such as paper and meat products, are projected to see export growth slow down.

Some argue that "today's hyper-extended supply chains have reached their limits."[4] Labour costs, a main driver of off-shoring, have been rising abroad. For example, it is estimated that labour costs in China are now nearly as high as in the U.S., compared with less than one-third 15 years ago.[5] Increasing consumer demand for faster response in product delivery is attracting production and inventory closer to the end user - that is, near consumer markets.[6] As well, the ongoing take-up of automation and robotics in production processes frees production from the need to locate in low-wage locations. It is suggested that supply chains in some industries are compressing to bring production and inventory closer to the end user, with manufacturers moving production facilities closer to markets.[7]

These factors point to the potential repatriation of manufacturing activity to locations in the advanced economies. Whatever term is used to describe the phenomenon - "reshoring," "nearshoring," or the "renaissance" of manufacturing - it signals a fundamental shift in the locational drivers of production from access to cheap labour to access to final markets and other key inputs.[8]

As the economy continues to restructure to focus on more high-value-added, sophisticated products, as the costs of advanced manufacturing techniques and robotics fall, as the potential costs of complexity and vulnerability of global supply chains mount, as the benefits of co-locating manufacturing with innovation and research capacity emerge, the economics and competitive advantages of local production improve.

Despite evidence that the reshoring of manufacturing has already taken place in some industries in the U.S., and that more is anticipated,[9] there is no Canadian research to draw upon. Conditions and drivers in Canada and the GGH may differ from those in the U.S. and will require research and analysis. Nevertheless, the potential reshoring of manufacturing signals a significant shift in locational patterns from previous decades, and has important implications for planning, chief among them the need to ensure suitable sites in the GGH.

Automation and advanced manufacturing technologies are prompting a transformation in manufacturing referred to by some as "Industry 4.0," "Manufacturing 4.0," or the "smart factory." In addition to the use of robotics in manufacturing and assembly, other technologies include additive manufacturing (that is, 3D printing), "smart" systems including the augmented use of sensors and data analytics in production processes, and computer numerically controlled machine tools and production cells.

Table 20 shows the share of firms in the manufacturing sector that have adopted different advanced technologies in Ontario, compared with the country as a whole.[10] Although advanced technologies are being adopted by Ontario companies, Canada still lags behind many countries in the adoption of production robotics.[11] Investment in technology among Canadian manufacturers remains significantly lower than that of manufacturers in other countries, especially in the United States.[12]

Table 20: Adoption of select advanced technologies in manufacturing, Canada and Ontario, 2014

Type of advanced technologies | Canada | Ontario |

% of firms adopting | ||

Virtual product development or modelling software, including computer-aided design (CAD), computer-aided engineering (CAE), and computer-aided manufacturing (CAM) | 36.8 | 42.3 |

Intercompany computer networks, including extranet and electronic data interchange (EDI) | 25.9 | 31.3 |

Wireless communications for production | 17.5 | 20.3 |

Computer-integrated manufacturing (CIM) | 14.9 | 13.6 |

Automated systems for inspection (for example, vision-based, laser-based, X-ray, high-definition (HD) camera or sensor-based) | 10.9 | 13.3 |

Robot without sensing or vision systems | 8.0 | 10.6 |

Software integration of quality results with planning and control software | 9.2 | 8.7 |

Flexible manufacturing cell (FMC) or flexible manufacturing system (FMS) | 6.5 | 8.2 |

Virtual manufacturing | 7.3 | 7.8 |

Sensor network and integration | 7.1 | 7.6 |

Automated machinery for sorting, transporting, or assembling parts | 6.3 | 6.9 |

Robot with sensing or vision systems | 5.7 | 6.0 |

Additive manufacturing including rapid prototyping for plastics and 3D printing for plastics | 4.6 | 5.8 |

Additive manufacturing including rapid prototyping for materials other than plastics and metals, and 3D printing other than plastics and metals | 1.9 | 3.1 |

Additive manufacturing including rapid prototyping for metals and 3D printing for metals | 2.5 | 2.8 |

The potential impact of robots and other forms of automation on employment within manufacturing is the subject of some debate. Some research across industrialized countries shows that the rising use of robots in manufacturing was not associated with overall manufacturing employment losses.[13] Other analysis shows that employment in manufacturing industries is amongst the most vulnerable type of employment to automation.

To date, robots have been relegated to highly controlled environments, but they are becoming more integrated with AI and will come to perform a wider range of tasks, including less routine ones. In Chapter 4 we present an assessment of the vulnerability to automation for manufacturing and all other GGH industries, and the geography of that vulnerability.

This analysis looks only at the potential job losses associated with automation. There is also potential job gain. Automated production processes still require workers, although of a different kind - such as AI specialists, engineers, data analysts, or computer programmers. Analytics is increasingly being used to improve production, planning, process monitoring, and decision-making.[14] Workers will still be needed in factories "to manage and make sense of the new technologies."[15] So the adoption of automated technologies in factories will likely require fewer but more skilled workers.

With off-shoring and the shedding of lower value-added production, "developed-world manufacturing," like that in the GGH, has tended to become more focused on sophisticated, high-value engineered products that call for particular skills, investments, and technical know-how, such as pharmaceuticals, aerospace, and automobiles.[16] The GGH has experienced this kind of restructuring in its manufacturing sector.

However, new drivers and technologies may alter past trajectories. The new technologies, in combination with other factors, suggest at least the possibility of some reshoring of production. However, even if the GGH were to see a repatriation of some types of manufacturing, it would not necessarily be accompanied by significant numbers of manufacturing jobs, especially low-skilled ones, but rather, rely more on automation and other advanced production technologies, and a smaller number of higher-skilled jobs.

At the same time, the manufacturing of products aimed at local markets may expand, as population and jobs continue to grow in GGH. The food and beverage sector is one example. Overall, there remains the possibility of demand for sites to accommodate advanced and other manufacturing facilities, which should be factored into discussions about the future of employment lands across the GGH.

The adoption of automated and advanced production technologies suggests that access to high-skilled workers may become a more important locational factor for manufacturing, while access to the low or moderately skilled labour that was needed in the past may become less important.

And as manufacturing facilities become less employment-intensive and more capital-intensive, employment trends, which have been used in the past, may become a less reliable predictor of the demand for manufacturing floor area.

Map 31: Other Manufacturing Archetype Employment, GGH, 2016

Map 32: Other Manufacturing Archetype Employment Change, GGH, 2006-2016

[1] Statistics Canada. Table 14-10-0023-01 Labour force characteristics by industry, annual (x 1,000). https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=1410002301

[2] International Federation of Robotics, 2017.

[3] Office of the Parliamentary Budget Officer, The Canada-EU Comprehensive Economic and Trade Agreement: A prospective analysis, 2017; see also Global Affairs Canada, Economic impact of Canada's participation in the Comprehensive and Progressive Agreement for Trans-Pacific Partnership, 2018, regarding the impacts of the CTPPP.

[4] CBRE and Oxford Economics, The Future of Global Manufacturing, 2017, p. 16.

[5] Ibid., p. 21.

[6] Ibid., p. 16.

[7] Ibid., p. 16.

[8] Erik Brynjolfsson and Andrew McAfee, The Second Machine Age: Work, Progress, and Prosperity in a Time of Brilliant Technologies, Norton, 2014.

[9] Boston Consulting Group, "Reshoring of manufacturing to the US gains momentum," 2015.

[10] Statistics Canada, CANSIM 358-0404.

[11] Oschinski and Wyonch, Future Shock? 2017, Figure 2, p. 6.

[12] Lamb, Munro, and Vu, Better, Faster, Stronger, 2018.

[13] George Graetz and Guy Michaels, "Robots at Work," CEP Discussion Paper 1335, London: Centre for Economic Performance, 2015, cited in Oschinski and Wyonch, Future Shock? 2017.

[14] Lamb, Munro, and Vu, Better, Faster, Stronger, 2018.

[15] JLL Inc., "How will Industry 4.0 impact US manufacturing?" Real Views article, 2018.

[16] CBRE and Oxford Economics, The Future of Global Manufacturing, 2017, p. 11.