The Arts and Design-Related (A&D) Archetype comprises employment in films, television, sound recording, advertising, book and magazine publishing, and performing arts and artists. Arts- and design-related industries tend to cluster in large cities,[1] and this is true of the GGH, where A&D represented almost 113,000 jobs. The Archetype has shown above-average job growth - some 10,000 additional jobs, or an increase of almost 10 percent, between 2006 and 2016.

Table 11: Arts and Design Archetype Employment, GGH, 2006 and 2016

| 2006 | 2016 | Change | % Change |

Arts & design | 102,645 | 112,665 | 10,020 | 9.8 |

Archetypes total | 1,481,595 | 1,459,825 | -21,770 | -1.5 |

Total GGH core employment | 2,300,015 | 2,375,465 | 75,450 | 3.3 |

Total GGH employment | 3,437,935 | 3,710,915 | 272,980 | 7.9 |

Not only does A&D employment tend to concentrate in the largest cities, but within those cities has a strong tendency to cluster in central areas. One study for U.S. cities found that of a selection of advanced industries, arts and culture industries were the most highly clustered at the regional scale, and as well the most clustered in the central city.[2]

Research by Gregory Spencer on the location of arts-related firms in Toronto, Montreal, and Vancouver mirrored the findings for U.S. cities: locational patterns were similar in all three Canadian cities.[3] Arts-related businesses tended to locate at the edges of the central business district, in older, denser, mixed-use, transit-served, and walkable areas. There was considerable overlap between living and working; many arts workers lived and worked in the same neighbourhoods, often in the same premises. In fact our data show that in this Archetype, many worked at home - representing 34,000 jobs in 2016 (in addition to the 113,000 jobs at a usual place of work indicated in Table 11).

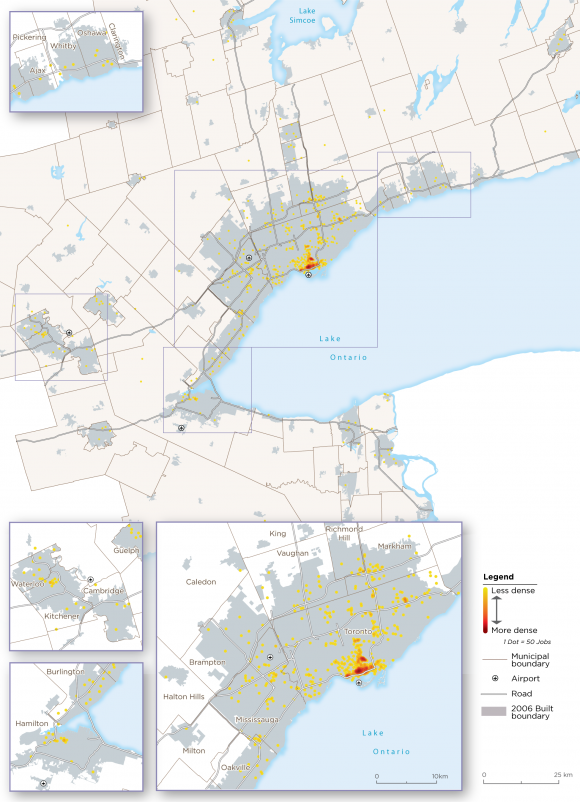

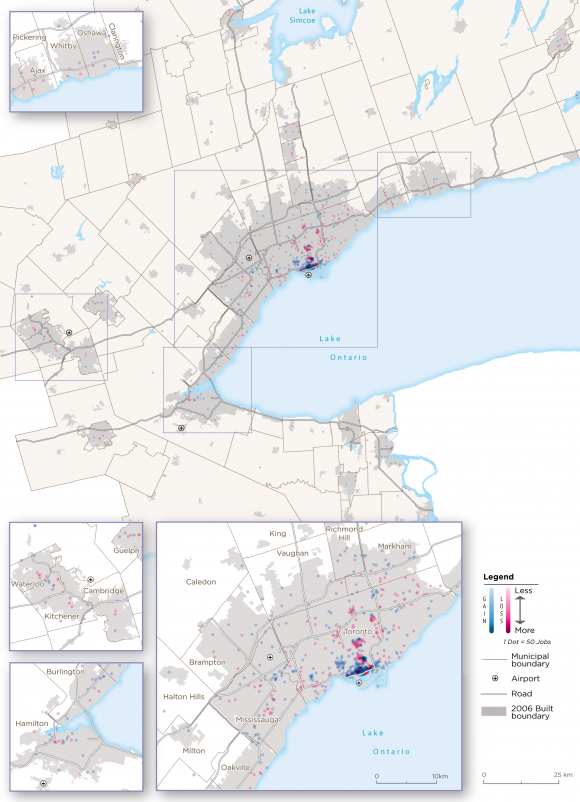

The pattern for A&D employment in the GGH is consistent with these observations. Employment in this Archetype is mainly concentrated in and at the edges of Downtown Toronto, extending east and west along Queen Street. There is scattered employment elsewhere in the region, but no secondary concentrations outside the central area. In fact, the City of Toronto accounted for almost two-thirds of GGH jobs in the Arts and Design-related Archetype. (See Maps 11 and 12.)

The edges of the core tend to contain a tight and fine-grained mix of uses, including residential neighbourhoods, a wide range of industries, shops, services, and meeting places like cafes. These are dense older urban areas with low- or mid-rise buildings - although in some areas with intense development pressures, taller buildings are being built. Many businesses are located in repurposed former factory or warehouse buildings, which have proved very flexible and attractive to a wide range of new businesses. As well, these areas tend to have higher levels of transit service.

Some of the scattered A&D employment outside Downtown Toronto and its edges could include relatively large employers in television broadcasting studios or film production locations. These locations require large studio facilities, often with extensive truck and vehicle parking. Some are currently found on the 401 in Scarborough (CTV), or in the Don Mills office park (Global TV), for example. New large-scale production facilities have recently been announced for Markham and Mississauga.[4]

Research has found that individual arts and culture industries benefitted by co-locating with other industries, especially design with art; music with film; and performing arts with music, as well as other knowledge-intensive industries (such as technology and media) and amenities such as cafes.[5] Older, denser, mixed-use, transit-served and walkable areas offer the possibility of social interaction and networking on both formal and informal bases, in a sector characterized by smaller firms, supporting production that is often organized on a project-by-project basis.

Globalization has affected the Arts and Design Archetype. Many industries have strong national and international roles. For example, Toronto is the third-largest film and television production location in North America, after Los Angeles and New York City.[6] Motion pictures, videos, and sound recording are all tradable industries. The film industry, for example, attracts foreign productions to shoot in Toronto, while Canadian-made movies can be sold in international markets.

Digital and communications technologies are also transforming these industries. This transformation includes the digitization of content (movies, books, TV shows, music, etc.), as well as the creation of new products and industries, such as mobile apps, e-learning, mobile gaming, and new services, such as music streaming. In some cases, opportunities are created by lowering barriers to entry (such as online publishing, marketing, distribution, and selling), and improving access to markets, including global markets. However, the same forces have also created increased competition in the home market from foreign sources.[7] Industries in this Archetype are still adapting to and exploiting change associated with new and emerging technologies.

Arts and culture industries have resisted migrating outside central areas, despite direct and indirect costs, such as congestion or high house prices. Researchers suggest that even in cities like New York, "particular geographies attain a competitive lock-in that is almost impossible to usurp."[8] There is some evidence, however, of some activities relocating away from central Toronto, to lower-cost locations, such as artists moving to Hamilton. Spencer notes a gradual shift farther away from the edges of the Downtown Toronto core, from Queen West to Parkdale to the Junction, [9] a push likely resulting from increasing rents in central areas and competition from other industries, like Soft Tech.

This shift raises an important issue: if the Arts and Design Archetype continues to expand, and given its particular urban characteristics, where will firms and employment locate in the GGH? Opportunities in the traditional types of urban environment sought by Arts and Design firms (central, older, flexible warehouse spaces) are becoming rare and/or unaffordable. This is a strategic land use planning question that a forward-looking land use plan could and should address.

Map 11: Arts and Design-Related Archetype Employment, GGH, 2016

Map 12: Arts and Design-Related Archetype Employment Change, GGH, 2006-2016

[1] Currid and Connolly, "Patterns of knowledge," 2008; Carl Grodach, Elizabeth Currid-Halkett, Nicole Foster, and James Murdoch III, "The location patterns of artistic clusters: A metro- and neighborhood-level analysis," Urban Studies 2014, 5 (13): 2822-2843; Gregory M. Spencer, "Knowledge neighbourhoods: Urban form and evolutionary economic geography," Regional Studies, 2015, 49 (5): 883-898.

[2] Currid and Connolly, "Patterns of knowledge," 2008.

[3] Spencer, "Knowledge neighbourhoods," 2015. Arts-related firms included in this study were: Motion picture/video, excluding movie theatres (NAICS 5121), sound recording (5122), radio and TV broadcasting (5151), specialized design (5414), performing arts companies (7111), and independent artists, writers and performers (7115).

[4] Tim Kelly, "Markham Movieland project gives big boost to TV, film production in city," Markham Economist and Sun, September 12, 2018; Tony Wong, "Why CBS set its sights on Mississauga for new TV production hub," Toronto Star, September 27, 2018.

[5] Elizabeth Currid and Sarah Williams, "Two cities, five industries: Similarities and differences within and between cultural industries in New York and Los Angeles," Journal of Planning Education and Research, 2010, 29 (3): 322-335, p. 331; Grodach et. al., "The location patterns of artistic clusters," 2013.

[6] Communications MDR, "Environmental Scan of the Culture Sector," Ontario Culture Strategy Background Document, prepared for the Ontario Ministry of Tourism, Culture and Sport, 2016, p.12.

[7] Ibid.

[8] Currid and Connolly, "Patterns of knowledge," 2008, p. 429.

[9] Spencer, "Knowledge neighbourhoods," 2015, p. 893.