With the adoption and diffusion of new and emerging automation technologies, certain types of work could be eliminated or workers replaced by machines. The potential for automation to expand from routine work tasks to more complex, non-routine tasks is a further challenge.

Some types of work and industries are more vulnerable to automation than others. As a result, some employment areas, towns, and cities within the GGH will experience the impacts of automation more than others because of the resulting job losses, industry restructuring, or the changing needs of industry and businesses.

Automation could alter demand for certain types of facilities (increasing or decreasing), which in turn affects planning for areas of growth, transition, or decline. It could also change companies' facility requirements (building floor areas, heights), locational requirements (as labour needs change), and requirements for specific urban environments.

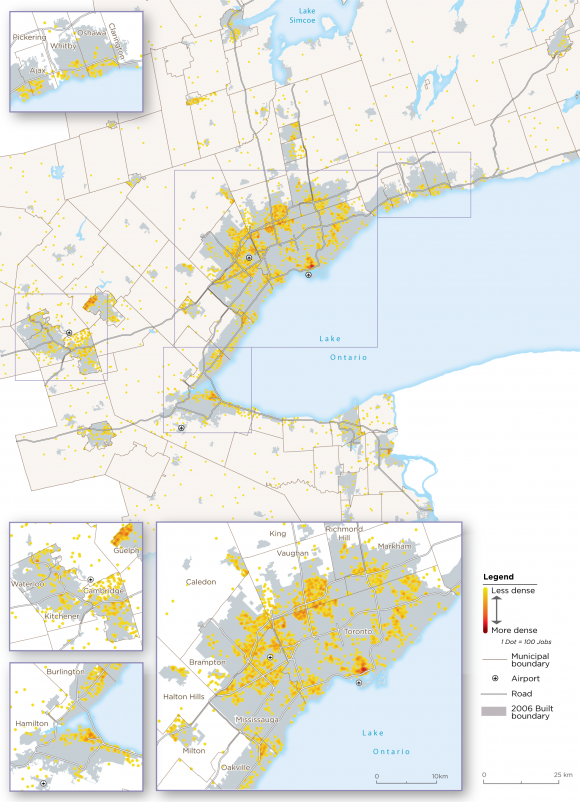

In this section, we map the location of employment in the industries with the largest proportion of jobs at high risk to automation. Of course, automation will also create employment. This job creation will also have a particular geography, but there are no available data to draw upon to map the potential upside to automation. The upside may have a different geography - that is, job losses may not occur in the same places as job growth.

Method

Our analysis builds on research undertaken by Matthias Oschinski and Rosalie Wyonch of the C.D. Howe Institute. In their 2017 analysis, Future Shock? The Impact of Automation on Canada's Labour Market, the authors estimated, for each industry, the share of employment that was considered at low, medium, or high risk of automation.

We applied this automation vulnerability assessment to employment in the GGH. We focused on industries in which more than 60 percent of employment was determined to be at high risk. We then mapped the location of employment in those industries within the GGH using our 2016 Place of Work data.

Results

Table 21 presents the data. The first thing to notice is that in fact the share of employment at high risk of automation is substantial across almost all industries. Most of the industries with the highest levels of vulnerability to automation are in manufacturing. In the GGH, employment in these most vulnerable industries adds up to 692,635 jobs.

Map 33 shows the locations of those jobs, with the exception of employment in restaurants, a sub-category of accommodation and food services accounting for 227,000 jobs, which are shown separately on Map 34. Map 33 reveals that the locations with high vulnerability to automation reflect locations of manufacturing employment generally. The three megazones, Toronto's inner suburbs, and, perhaps surprisingly, its downtown area (primarily employment in hotels), included in Accommodation and food services all show a significant presence of the most vulnerable employment. Other vulnerable areas include Guelph, Oshawa, Alliston, Cambridge, and Oakville, likely representing concentrations of motor vehicle-related manufacturing.

Map 34 shows employment in restaurants separately, as this not considered "core" employment but rather population-related, and tends to mirror the geographic distribution of residential population.

Note that the employment mapped represents all the employment in any given industry - not just jobs that are most vulnerable. We have no way of knowing which exact jobs in which particular locations fall into the 62 percent of jobs in rubber, plastics, and chemicals manufacturing, for example, that are at high risk, versus the 38 percent that are at medium or low risk. Still, the map indicates the locations of employment in those industries with the highest vulnerability. Oschinski and Wyonch's 2017 analysis used data for Canada, and we have assumed that the same percentages of jobs at high risk by industry that they found nationally apply within the GGH.

Some municipalities may be more vulnerable to automation than others, depending upon their current industrial structure. Table 22 shows employment in those industries at highest risk to automation (the industries highlighted in blue in Table 21) as a share of total employment by municipality. Only GGH municipalities with total employment of more than 10,000 jobs are shown in this table. Vulnerable industry employment makes up a significant share of total jobs as well as large absolute numbers in cities such as Cambridge, Guelph, Brampton and Vaughan. Other municipalities focused on tourism (the accommodation and food services industry), such as Niagara and Niagara-on-the-Lake, also have high employment vulnerability. Although the City of Toronto has the highest overall number of vulnerable jobs, given its diversified economy, as a share of total jobs, its vulnerability is well below the GGH average of 18.7 percent.

Some municipalities, such as Waterloo, may have relatively low vulnerability because their economy skews toward the less vulnerable industries, such as computer systems design, with just 3 percent of jobs considered at risk. Other, smaller municipalities may be dominated by population-related industries, with little vulnerable manufacturing. While the potential impact of automation would be lower in industries with less than 60 percent of employment determined to be at high risk, automation can still have significant effect on all industries and municipalities.

Table 21: Share of employment at high risk of automation by industry, GGH, 2016

Sorted by share of employment at high risk, from highest to lowest | ||

| % of employment at high risk | Number of jobs |

Fishing, hunting, and trapping | 94.2 | 115 |

Agriculture | 92.2 | 18,885 |

Motor vehicle, body, trailer, and parts manufacturing | 74.6 | 73,235 |

Paper manufacturing | 71.9 | 10,600 |

Accommodation and food services | 71.8 | 278,220 |

Food and beverage products | 69.8 | 63,615 |

Manufactured mineral products | 69.0 | 31,555 |

Mining and quarrying (except oil and gas) | 67.7 | 3,100 |

Wood product manufacturing | 67.2 | 7,530 |

Printing and related support activities | 64.9 | 18,425 |

Metal fabrication and machinery (excluding electrical) | 63.7 | 74,910 |

Other manufacturing | 62.2 | 53,590 |

Rubber, plastics, and chemicals | 61.8 | 58,855 |

TOTAL OF ABOVE |

| 692,635 |

Forestry and logging with support activities | 59.5 | 635 |

Transportation and warehousing | 56.7 | 163,780 |

Management, administrative, and other support | 54.7 | 151,490 |

Retail trade | 49.7 | 463,405 |

Computer, electronic, and electrical products | 44.1 | 30,345 |

Other transportation equipment manufacturing | 42.5 | 16,350 |

Construction | 40.3 | 127,390 |

Support activities for mining and oil and gas extraction | 40.1 | 1,440 |

Other services | 31.6 | 156,045 |

Utilities | 30.0 | 26,730 |

Information, culture, and recreation | 29.0 | 174,290 |

Finance, insurance, real estate, and leasing | 28.5 | 347,275 |

Oil and gas extraction | 26.5 | 860 |

Wholesale trade | 25.5 | 169,880 |

Public administration | 25.2 | 181,140 |

Professional business services | 21.7 | 144,660 |

Health care and social assistance | 17.8 | 406,545 |

Educational services | 16.4 | 300,175 |

Other professional services | 12.6 | 55,650 |

Management, scientific, and technical services | 7.9 | 30,460 |

Computer system design services | 3.0 | 68,210 |

TOTAL ALL INDUSTRIES |

| 3,710,915 |

Table 22: Employment in industries at high risk of automation as a share of total industry employment, municipalities with over 10,000 total jobs, GGH, 2016

Sorted by share of employment at high risk, from highest to lowest | ||||

| Employment in Most Vulnerable Industries | Total Employment | % of Total Employment | |

Greater Golden Horseshoe | 692,635 | 3,710,915 | 18.7% |

|

New Tecumseth | 8,685 | 16,515 | 52.6% |

|

Niagara-on-the-Lake | 3,500 | 10,240 | 34.2% |

|

Cambridge | 21,075 | 62,130 | 33.9% |

|

Haldimand County | 4,385 | 12,955 | 33.8% |

|

Niagara Falls | 12,025 | 35,560 | 33.8% |

|

Woolwich | 4,175 | 12,540 | 33.3% |

|

Guelph | 23,040 | 69,670 | 33.1% |

|

Brant | 3,415 | 10,820 | 31.6% |

|

Caledon | 5,710 | 19,770 | 28.9% |

|

Brantford | 10,170 | 36,910 | 27.6% |

|

Vaughan | 42,045 | 158,280 | 26.6% |

|

Halton Hills | 4,360 | 17,845 | 24.4% |

|

Brampton | 36,365 | 156,125 | 23.3% |

|

Milton | 6,900 | 30,490 | 22.6% |

|

Orangeville | 2,455 | 10,930 | 22.5% |

|

Oakville | 16,820 | 81,240 | 20.7% |

|

Aurora | 4,625 | 22,355 | 20.7% |

|

Burlington | 16,100 | 78,665 | 20.5% |

|

Hamilton | 38,055 | 187,500 | 20.3% |

|

Newmarket | 6,975 | 35,220 | 19.8% |

|

Ajax | 4,960 | 25,500 | 19.5% |

|

St. Catharines | 9,715 | 51,275 | 18.9% |

|

Clarington | 3,825 | 20,295 | 18.8% |

|

Whitby | 6,950 | 37,060 | 18.8% |

|

Kitchener | 15,350 | 83,365 | 18.4% |

|

Oshawa | 8,845 | 48,340 | 18.3% |

|

Barrie | 9,875 | 56,110 | 17.6% |

|

Whitchurch-Stouffville | 1,765 | 10,155 | 17.4% |

|

Kawartha Lakes | 3,010 | 17,425 | 17.3% |

|

Mississauga | 66,895 | 394,660 | 17.0% |

|

Richmond Hill | 9,150 | 54,890 | 16.7% |

|

Orillia | 2,490 | 15,015 | 16.6% |

|

Welland | 2,385 | 14,780 | 16.1% |

|

Peterborough | 6,000 | 38,435 | 15.6% |

|

Pickering | 4,540 | 29,515 | 15.4% |

|

Waterloo | 8,855 | 59,025 | 15.0% |

|

Markham | 18,145 | 127,400 | 14.2% |

|

Toronto | 181,865 | 1,342,435 | 13.5% |

|

Map 33: Employment in Industries with Highest Vulnerability to Automation, GGH, 2016

Map 34: Employment in Industries with Highest Vulnerability to Automation -Restaurants, GGH, 2016