Shopping is an important part of everyday life -- providing both access to consumer goods and opportunities for employment within an increasingly services-oriented economy. Where we shop, how we get there, and what we purchase to some extent defines who we are and how others see us. Our motivations for shopping range from the personal (e.g., self-gratification, role-playing, meeting obligations) to the social (e.g., interaction, communication, peer group attraction) (Tauber, 1972; Underhill, 2000, 2004; Stokan, 2005). Why we shop is clearly a complex process and where we shop is often influenced by a combination of our personal preferences and our response to developmental, planning, and political decisions of which we are not always aware. These decisions collectively influence our choice of travel mode by affecting our access to shopping (and other non-work) destinations.

Many researchers have examined the influence of socio-technical processes (including innovation in technologies for moving information and people) on the development of cities and metropolitan regions (Adams, 1970; Audirac, 2002; Castells, 2002; Bourne, 2007). Less attention has been paid to the transformative impact of the retail economy on the size and shape of city-regions.

Recent data suggest that current forms of development have given rise to complex, non-uniform patterns of urban growth and change in Canadian metropolitan regions (Shearmur and Coffey, 2002). Overall, manufacturing and retailing have decentralized, particularly in Canada's eight largest Census Metropolitan Areas, including Toronto (Heisz and LaRochelle-Cote, 2005). Understanding the forces of decentralization, which help account for the changing spatial structure of Canadian city-regions, can advance knowledge about the relationship between urban sprawl and economic growth at the local, regional, and national scales.

Canada's retail landscapes reflect the immense diversity of social classes, incomes, ethnicities, lifestyles, and business formats in our cities. Retail strips, suburban plazas and malls, power centres, downtown shopping areas, and boutique districts are some of the most prominent elements of the urban landscape. The current retail system is the product of a series of complex structural changes and political-economic processes (Berry, 1963; Bromley and Thomas, 1993). The system is highly volatile as new retailers open and existing retailers close or relocate. Minor shifts in the income, demographic, lifestyle, or competitive characteristics of an area can lead to rapid changes in the form and structure of the retail environment (Simmons and Kamikihara, 2007).

The retail fabric of cities responds to demographic, technological, behavioural, and entrepreneurial change. In general, retailers choose their locations in response to market conditions. If the population and income mix of a particular area constitute an appropriate market for retail goods, retailers will attempt to move in. At the same time, the spatial pattern of retail groupings relates to the transportation technology of the time. When mobility was low (that is, before the era of the automobile), retail activities tended to concentrate; as mobility increased throughout the postwar era, retail activities tended to become more dispersed. At a finer scale, consumer preferences for particular goods and locations and entrepreneurial decisions in response to those preferences help determine the growth and decline of retail areas. Certain urban shopping areas go in and out of fashion for particular groups. Meanwhile, investment decisions are based on entrepreneurs' evaluation of the prospects of the market over time.

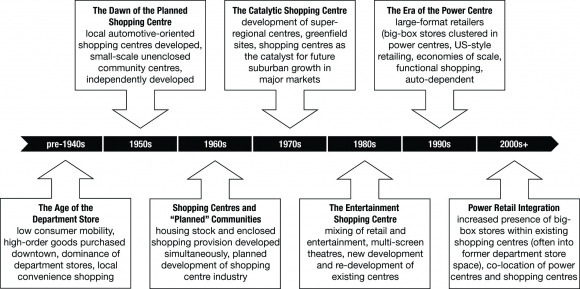

Figure 3: The evolution of the Canadian urban retail system

The Canadian urban retail system has experienced several transformations in the last 60 years. These transformations were tied to the evolution of urban structure and transportation: the compact pre-automobile city was succeeded by the dispersed automobile city, which is now giving way to an emerging information city. Figure 3 shows the major phases of evolution of the Canadian retail system for the period before the Second World War era to the present day.

Retail strips (street-front retail) have always been part of the urban retail system. They can be found in traditional downtowns as main shopping streets, clustered in the inner suburbs (often serving specialized functions), and dispersed throughout the outer suburbs along major arterial roads. Shopping centres date back to the 1950s, with major growth occurring through the mid 1960s to late 1970s. This period saw the build-out of suburban regional and super-regional centres in parallel with rapid suburban residential growth. Since the 1990s, power centres have dominated Canadian retail real estate development; only one new major shopping mall has been built in Canada since the mid 1990s.

The growth of large-format retail in Canada has been attributed to (1) the implementation of free trade agreements in the late 1980s and early 1990s; (2) the decline in the value of the Canadian dollar (1992-2004); (3) competition effects related to pricing and selection; and (4) innovation in design and site selection - i.e., the trend toward the development of highly visible, auto-accessible locations on inexpensive land (Hernandez and Simmons, 2006; Jones and Doucet, 2000). The rise of power retail in the GTA has resulted in some transformation of what consumers can expect to find at shopping centres (from retail to services), and the wholesale replacement or adaptive re-use of places previously used for other purposes (e.g., enclosed malls, industrial sites).

The proliferation of large-format retailing and the shift away from the enclosed shopping centre have been reinforced by escalating land costs, the high costs borne by shopping centre tenants (base rent, property tax, common area maintenance fees), and the opening up of markets (and subsequent influx of U.S. retailers like Wal-Mart in 1994) following the free trade policies of the late 1980s and early 1990s.4 The result has been the production of a highly suburbanized auto-oriented retail landscape dotted with big boxes, power centres, and power nodes, accessible primarily by automobile -- places with lower capital and operating cost structures than other retail formats.

The introduction and subsequent growth of large-format and power centre retailing did not occur either quickly or at the same rate through time (Jones and Doucet, 2000). While much of the growth of large-format retailing in the GTA occurred during the 1990s, early signs of what was to come emerged in the GTA as early as the 1960s -- IKEA opened in 1962, Leon's in 1973, and Knob Hill Farms in 1971 (Jones and Doucet, 2000, 2001). The data also suggest that the growth of the retail economy in general, and big-box retailing specifically, has ebbed and flowed alongside the success and failure of the broader regional economy. For example, the recession of the early 1990s was a period of slow growth in big-box retailing in the GTA (Jones and Doucet, 2000). Overall, and despite short-term cycles of growth, the staying power of large-format retail derives from its dramatic success relative to other retail formats (Jones and Doucet, 2000).

Notes

4. The authors would like to thank Gordon Harris for his insights.