The TYE megazone contains two main types of built environment. Office parks, such as those in the Commerce Valley Drive, Allstate Parkway, and Cochrane Drive areas, are characterized by multi-storey buildings with relatively low lot coverage. Other areas are dominated by single-storey, industrial-form buildings that tend to have relatively high lot coverage, such as the area around Denison Street.

At present, the office parks hold the greatest potential for densification. These areas tend to have small-floorplate buildings, with low lot coverage and large surface parking lots. In contrast, the industrial-style buildings tend to have larger floorplates and higher lot coverage, and are usually in the centre of each lot, with surface parking surrounding the building. The surface parking lots are not configured to allow the addition of new buildings - although expansions of existing buildings are possible.

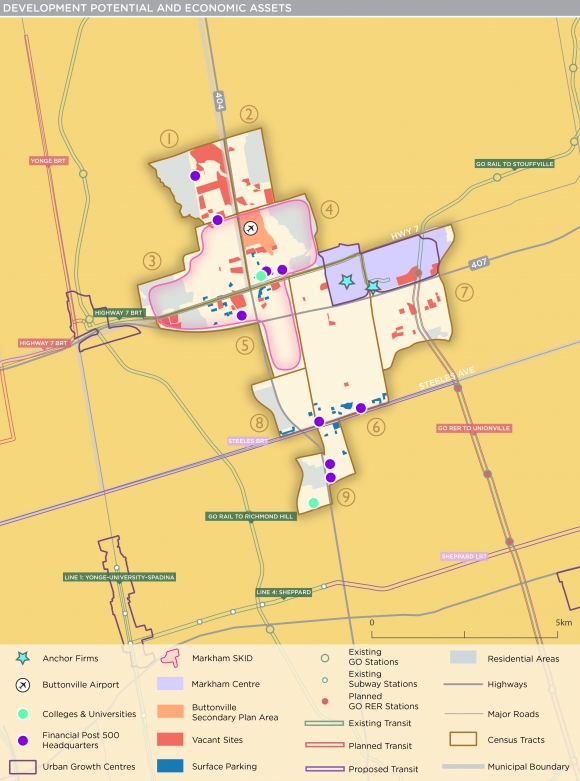

The three census tracts that make up the Markham SKID, in which most of the office parks are found (surrounding the intersection of Highways 7 and 404), contain about 55 hectares of vacant land.1 A rough estimate suggests that if each vacant site were to be developed at a modest office floor space index2 of 1.0 times the lot area (equivalent to, for example, a two-storey building covering 50% of the lot), almost 550,000 square metres of new employment space could be created. At typical office occupancy rates,3 this new development could accommodate an additional 24,000 to 32,000 workers.

This estimate does not include additional areas that could be redeveloped, such as surface parking lots. In the same three census tracts, developable surface parking represents at least 18 hectares - in particular along Highway 7 and in the office parks surrounding the intersection of Highways 404 and 7.4 This land represents the potential for an additional 180,000 square metres of office development, accommodating 8,000 to 10,000 workers. These development sites are all within a one-kilometre distance of the Highway 7 Bus Rapid Transit (BRT) route - challenging an oft-made argument that suburban employment sites cannot be effectively served with higher-order transit due to low densities and the "last mile" issue.

Altogether, a conservative estimate suggests the potential to add 32,000 to 42,000 workers to these areas. This is almost enough to accommodate all of the projected employment growth in major office employment for the entire City of Markham to 2041 - about 46,000 new jobs.5

The addition of office uses in sites clustered along or near the Highway 7 corridor would support increased transit ridership along the Viva Bus Rapid Transitway and contribute to the urbanization of this regional corridor, York Region's most significant east-west connector. Directing future office uses to key transit-served locations like the Highway 7 corridor is critically important to reducing the auto-dependence of suburban employment areas that is the cause of so much of the region's traffic congestion and greenhouse gas emissions.

In addition, there are about 22 hectares of developable land in surface parking lots within one kilometre of Steeles Avenue, suggesting further potential to densify along this corridor.

In Tor-York East, additional potential lies in the redevelopment of the Buttonville Airport site east of Highway 404. A plan currently before the Ontario Municipal Board proposes a mix of land uses on this site, including residential and retail, and a business park with 418,000 square metres of office/institutional development, representing an estimated 16,700 jobs.6 A critical issue for this proposal is whether frequent transit will be provided to support the scale of development.

EMPLOYMENT LANDS VS. CENTRES AND CORRIDORS

According to a report completed in 2015 using data from 2013, an estimated 82% of York Region's total office employment is located in employment lands, with just 13% in the region's centres and corridors.7 In terms of major office floor space, 75% is located in employment lands, and 13% in centres and corridors.8

This pattern has been improving, with 23% of major office floor area locating in centres and corridors between 2006 and 2013. Still, 76% of new major office floor space has been built on employment lands.9 This pattern represents a missed opportunity to shift employment to more transit-accessible locations and thereby support the region's transportation infrastructure investment. Shifting office development from employment lands to centres and corridors would also lessen demands for new greenfield development areas and urban boundary expansions, freeing up existing and future employment lands for industrial activity.

Putting more employment in transit-supported areas will require a concerted approach to addressing obstacles, such as zoning, parking requirements, and non-residential development charges that act as a disincentive to creating denser buildings and adding new development within already urbanized areas. The nature of the built environment also poses challenges. The Highway 404/407 interchange and the large scale of arterial roads make it harder to urbanize the surrounding areas and to integrate transit with development. Integration with existing and improved transit, an updating of the area, and a plan to address the needs of knowledge-intensive activities while supporting the major ICT cluster and attracting further investment are all needed.

[1] Vacant sites were identified using the York Region Vacant Employment Land Inventory and measured using the Parcels dataset from York Region Open Data.

[2] A floor space index is the measure of the floor area of a building divided by the area of its lot.

[3] A very conservative 23 sq. metre per worker was used to arrive at the lower number. Many facilities have lower floorspace per worker. A figure of 17 sq. metre per worker was used to arrive at the higher number.

[4] Only surface parking lots with an area greater than 0.5 hectares are included.

[5] York Region, 2041 Preferred Growth Scenario, Land Budget, November, 2015, p. 12.

[6] City of Markham, Report to Development Services Committee, Master Plan and Status Report Update, Application by CF/OT Buttonville Properties LP for Official Plan Amendment & New Secondary Plan for the Buttonville Airport Lands, May 7, 2013.

[7] Watson & Associates, York Region Employment Trends Review, September 25, 2015, Figure 61.

[8] Watson & Associates, York Region Employment Trends Review, September 25, 2015, Figure 67.

[9] Watson & Associates, York Region Employment Trends Review, September 25, 2015, Figure 68.