The Logistics Archetype includes freight transportation arrangement (freight forwarders, shipping agents, customs brokers), warehousing, and storage. In conjunction with storage, this Archetype includes services such as labelling, breaking bulk, inventory control and management, light assembly, order entry and fulfillment, packaging, pick-and-pack, price marking and ticketing, and transportation arrangement. Logistics establishments may be part of a broader corporation, such as a retail company, or a third-party warehouser serving corporate clients.

The Logistics Archetype saw significant employment growth between 2006 and 2016 - 7,500 jobs, a 30 percent increase.

Table 16: Logistics Archetype Employment, GGH, 2006 and 2016

| 2006 | 2016 | Change | % Change |

Logistics | 25,170 | 32,635 | 7,465 | 29.7 |

Archetypes total | 1,481,595 | 1,459,825 | -21,770 | -1.5 |

Total GGH core employment | 2,300,015 | 2,375,465 | 75,450 | 3.3 |

Total GGH employment | 3,437,935 | 3,710,915 | 272,980 | 7.9 |

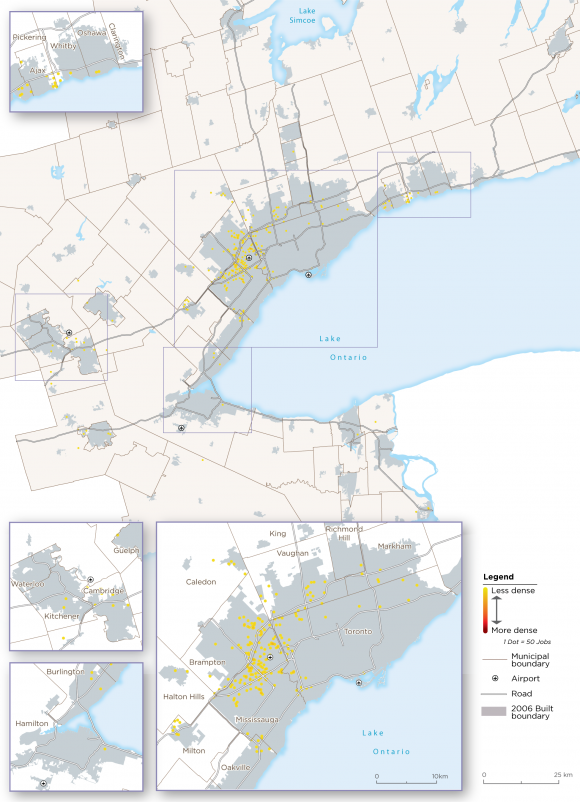

Logistics employment is primarily clustered around Pearson International Airport. There is a second, smaller cluster around the Intermodal terminal in Vaughan, and some additional employment in Milton and Kitchener-Waterloo. Proximity to intermodal facilities and airports is important, as is access to the highway network. Buildings can be extremely large - more than 1 million square feet in some cases, with high levels of truck traffic.

Logistics has been a growing sector of the economy in recent years, accounting for the construction of many warehouse and distribution facilities across the GGH, as evidenced by employment growth in Brampton, Mississauga, Caledon, and Vaughan, as well as locations along the 407, 401, and QEW Highways, including Pickering, Ajax, Cambridge, and Bradford. Notably, there have been few areas of employment loss in this Archetype. (See Maps 21 and 22.)

Different types of warehousing facilities exist, each with different functions and characteristics (see text box[1]) and subject to different drivers of change.

Type of warehouse/distribution buildings

Warehouse: A building primarily used for storage, and/or distribution of materials, goods and merchandise, e.g. bulk warehouse, refrigerator storage.

Distribution centre: A type of warehouse facility designed to accommodate efficient through-movement of goods, including overnight delivery services and air cargo.

Truck terminal: A specialized distribution building for redistributing goods from one truck to another as an intermediate transfer point.

Fulfillment centre: A distribution facility focused on fulfilling e-commerce orders, shipping to final consumers. |

Globalization and technological change are key drivers for this archetype. Levels of trade, the geography of that trade (that is, where goods are coming from and going to), and emerging technologies together shape supply chain configurations and in turn the amount, nature, and location of warehousing and distribution activity.

The expanding use of global supply chains has increased the demand for goods movement from production sites outside the country to final users in the cities of the GGH - and with it, demand for warehouse and distribution facilities.

At the same time, advances in information technology that have propelled e-commerce have brought about the globalization of consumer markets - or what some call the "globalization of shopping."[2] With the expansion of e-commerce, GGH consumers can buy products from around the world quickly and cheaply.

Growth in Canada-U.S. trade is expected to create additional demand for trucking facilities and warehouses.[3] However, disruptions to global trade could also have significant impacts, such as a reorientation of supply chains to accommodate greater domestic flow of goods (rather than networks arranged to distribute goods from overseas[4]) and "may reduce the need for large seaports in advanced economies, while increasing the need for larger inland and intermodal ports closer to population centres."[5] Such a shift could increase demand for warehousing facilities in and around the GGH. Any move away from off-shoring of production toward "nearshoring" could further add to the demand for trucking and warehousing facilities in the GGH.[6]

E-commerce and online shopping are also key drivers reshaping distribution networks and facilities. E-commerce is still evolving, with the potential for future technological and business model disruption that will affect the demand for, nature of, and location of warehousing and distribution facilities.

In this context, it is important to consider where we are currently on the e-commerce trajectory: have we reached peak online shopping (so that demand for warehousing facilities will level off) or does additional growth potential remain? In Canada, the take-up of online shopping lags behind that of other countries, suggesting additional growth potential. E-commerce accounted for 7 percent of $352 billion Canadian retail sales in 2016, compared with 10 percent in the U.S. and 15 percent in the U.K. (despite similar levels of computer use and Internet penetration).[7] Almost half of Canadian spending is from U.S. e-tailers, including Amazon, Walmart, Costco, eBay, and Apple.[8] Many Canadian retailers have yet to put in place e-commerce platforms. Indications are that the sector is still in its relative infancy, with the potential for further growth and disruption.

There has been a tendency for warehouses and distribution facilities to get larger over time - more than doubling in floor area, on average, in the last five years compared with those built between 2002 and 2007.[9] Distribution centres now range from 20,000 to 1,000,000 square feet, while fulfillment centres, the largest type, range from 400,000 to 1,500,000 square feet, typically with greater heights to allow for vertical storage.[10] For example, a recently completed Canadian Tire distribution centre in the municipality of Caledon measures 1,500,000 square feet and aims to serve all stores across the country.[11]

On the other hand, with pressures for next-day delivery, many are anticipating the addition of smaller distribution facilities or "localized delivery hubs" within urban areas, closer to final consumers and stores, as "last-mile" distribution facilities.[12] These local buildings do not need the size or height of regional facilities, and older existing buildings could be re-used for this purpose.[13] As well, future transportation infrastructure facilities (airports, intermodal terminals) will shape the geography of this Archetype.

Automation, including the use of robots in distribution and fulfillment facilities, will alter the employment profile of these buildings, including the worker-to-floorspace ratio. The amount of employment in these facilities is of interest to planners, particularly with respect to planning transportation and transit services that serve logistics clusters.

These observations suggest an ongoing need to plan for growth for this archetype in the GGH. Given the significant land needs associated with each facility, as well as the associated truck traffic, a more detailed assessment of this archetype's future needs is warranted, including a strategic, regionwide approach to accommodating and locating logistics facilities.

Map 21: Logistics Archetype Employment, GGH, 2016

Map 22: Logistics Archetype Employment Change, GGH, 2006-2016

[1] Definitions for warehouse, distribution centre and truck terminal from NAIOP, "NAIOP Terms and definitions: North American office and industrial market," NAIOP Research Foundation, 2012. Definition for fulfillment centre from CBRE, Keeping Pace: The rising importance of supply chain management, CBRE Research, 2015.

[2] NAIOP, "NAIOP Terms and definitions," 2012.

[3] CBRE, Keeping Pace, 2015.

[4] CBRE, Globalization and Logistics: What Next? 2017.

[5] Ibid., p. 6.

[6] CBRE, Keeping Pace, 2015.

[7] Dan Bodley, Peter Dawe, Sam Ridesic, and Matthew MacKenzie, "Will Canadian retailers meet demand as e-commerce takes off?" Boston Consulting Group, 2017.

[8] Ibid.

[9] CBRE, Keeping Pace, 2015, p. 6; CBRE, "Going large: Warehouse sizes increase for modern logistics," U.S. MarketFlash. November 17, 2017.

[10] CBRE, Keeping Pace, 2015.

[11] Ibid.

[12] Ron Derven, "The future of e-commerce fulfillment centers," NAIOP Development Magazine, Summer 2016; JLL, More than the Last Mile: How Smarter Logistics Can Help Shape Tomorrow's Cities, Research Report, April 2017.

[13] Derven, "The future of e-commerce fulfillment centers," 2016.